On February 10, 2025, President Trump issued a significant Executive Order titled Pausing Foreign Corrupt Practices Act Enforcement to Further American Economic and National Security. This order pauses the enforcement of the Foreign Corrupt Practice Act (FCPA) and directs the Department of Justice (DOJ) to review and issue new guidelines for enforcing the FCPA. The executive order states that the law has been “stretched beyond proper bounds and abused,” blasting it for hurting American businesses and impeding foreign policy objectives.

However, this reasoning is misguided. The FCPA, which generated over $1.6 billion in sanctions in 2024 alone, has been the best weapon to fight international corruption while also protecting American companies from unjust business practices and promoting an even playing field. Although the Executive Order mentions that certain practices are “routine” in other nations, that does not determine its legality, let alone encourage its acceptance. Furthermore, the assertion that FCPA enforcement has “harmed” U.S. companies by excluding them from a customary international norm is unfounded.

The DOJ guide to the FCPA, published under Trump’s first term, outlined that “corruption is bad for business.” Bribery and corruption lead to distorted prices, increase the cost of doing business, and inflate the cost of government contracts. Enforcement of the FCPA has protected U.S. businesses from these effects of international misconduct, especially regarding contract bribery. Corruption increases the cost of contracts in developing countries and renders them legally untenable. At the same time, officials engaging in contract bribery tend to escalate their demands over time, breeding corrupt practices.

Additionally, corruption leads to “market inefficiencies[,] instability, sub-standard products, and an unfair playing field for honest businesses.” Unquestionably, the FCPA has prevented economic dishonesty from infiltrating the American financial system. The consequences can also be internal. Corruption and bribery undermine employee confidence, facilitate wrongdoing from within, and make it difficult to conduct business overall. The FCPA has safeguarded U.S. companies by preserving advantages that international corporations engaging in corruption cannot receive. By eliminating its mechanisms, U.S. companies would not prosper but would flounder under international officials, seasoned in corruption and bribery, that could out-leverage inexperienced corporations. Not only that but the integrity of the American economy would become suspect under crippled FCPA enforcement, as illicit funds would flood the private sector.

While conserving healthy competition for U.S. businesses, the FCPA has also generated considerable profits for the government, meaning its absence would also harm the public sector. The idea that the FCPA harms or targets American economic interests is the complete opposite, as it is far from the truth.

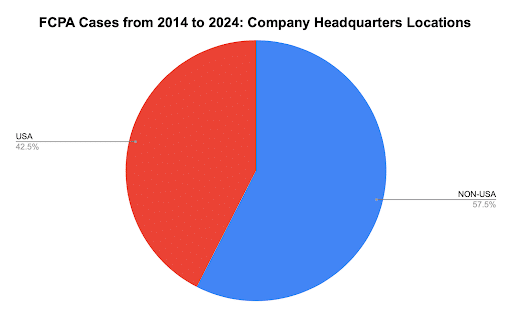

Since 2014, the FCPA has led to nearly $25.5 billion in sanctions being imposed. Of this amount, approximately $18.4 billion has been levied against foreign companies involved in non-U.S. FCPA cases. Most of the countries facing sanctions for FCPA violations are headquartered outside the U.S., with 57% of the cases involving non-U.S. entities.

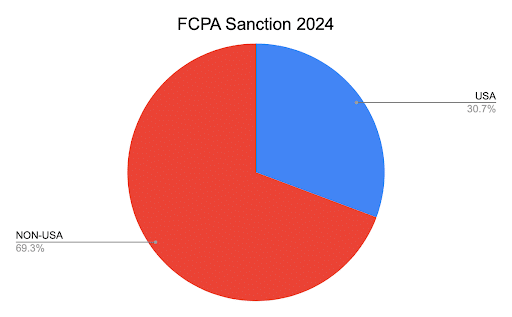

In 2024 alone, U.S. sanctions totaled roughly $500 million, accounting for just under 30% of the total sanctions imposed that year. Even on a per-case basis, foreign entities face the brunt of FCPA enforcement.

In 2024 alone, U.S. sanctions totaled roughly $500 million, accounting for just under 30% of the total sanctions imposed that year. Even on a per-case basis, foreign entities face the brunt of FCPA enforcement.

On average, U.S. sanctions are 42% less compared to non-U.S. sanctions. Arguing that the FCPA undermines or hurts the economic welfare of the U.S. is an argument grounded only in theory, not in practice, as the data shows.

The U.S. has continuously led the fight against bribery, corruption, and economic deceit through the FCPA. In contrast, many other countries lack the necessary legal frameworks to combat these crimes effectively. As such, the international strategy for anti-bribery enforcement is in serious jeopardy should the U.S. abandon its position further.

Clearly, the global effort against corruption and bribery will be hampered due to a U.S. departure. Over the last decade, the FCPA has secured convictions in over 150 cases and amassed over $25 billion in corporate sanctions with the help of at least 77 known whistleblowers. Since only a third of these sanctions were imposed on U.S. companies, the enforcement has largely shielded U.S. companies while targeting crooked international businesses. If there is a decline in the U.S. as a leader in anti-corruption efforts, strengthening global anti-corruption and whistleblower laws will be essential. The most appropriate nation to advance these regulations would be the United Kingdom, as its anti-corruption and anti-bribery structure is the best evolved in Europe, but still heavily underwhelming.

Nick Ephgrave, the Director of the United Kingdom’s Serious Fraud Office (SFO) states, “We know that many, many hundreds of whistleblowers have chosen to go abroad to blow the whistle, because there is simply no incentive they can do that here…That means that we don’t get the benefit of bringing those individuals or corporations to justice in this country. We don’t benefit financially from the fines and their compensation can come from successful convictions, and it means that people in my office are still scrambling around in the dark.” Undoubtedly, the results speak for themselves. The UK system is fully capable of productive sanctions in its current form, but a massive effort is still needed to normalize these results.

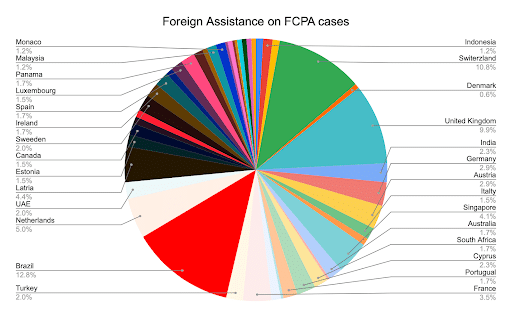

Since 2014, Brazil has assisted the U.S. 44 times, while Switzerland and the United Kingdom have contributed 38 and 34 times, respectively. In Europe, the Netherlands, Latvia, and France have collectively matched Brazil’s level of assistance over the past decade. This demonstrates that while foreign litigators recognize the effectiveness of the FCPA.