Bradley Birkenfeld was born in February of 1965 in a household where his mother was a nurse/housewife, and his father was a neurosurgeon. He had two older brothers and remembers a childhood full of sports and friends in Brookline, Massachusetts. Both of Birkenfeld’s parents were in the “giving industry.” It used to be a prestigious job to help people back in the ’60s and ’70s in the medical profession, and Birkenfeld stated that seeing what his parents did to help others “resonated” with him.

Birkenfeld stated that parents have a more significant role in their child’s life than they think. Sometimes that influence is subliminal, and other times it is right on the surface. Birkenfeld’s parents were “very giving,” which played a large and influential part of how Birkenfeld is today. He had an “excellent upbringing” and an outstanding education. Birkenfeld stated that he is not a religious person, and religion did not play a large part in who he is today.

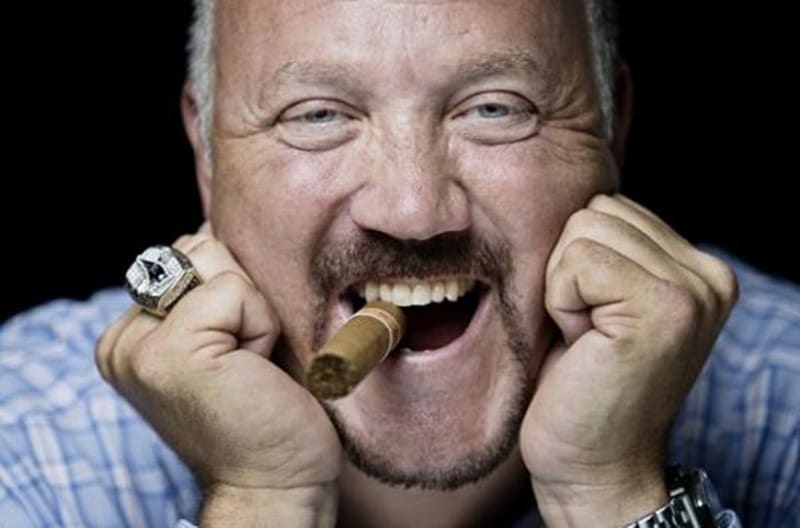

Birkenfeld said that he saw his parents helping others all the time, and he feels he is “cut from the same cloth” as his parents. With two older brothers, Birkenfeld played physical sports like ice hockey and football and feels sports are vital in how you grow into a man. He had an innate feeling to help others, reflected by letters in his file throughout his banking career. Birkenfeld attended Thayer Academy, a prep school, then followed up at Norwich University in Vermont, graduating in 1988. He got his master’s degree at the American Graduate School of Business at La Tour-de-Pilz, Switzerland. Birkenfeld still has friends from his school days.

Educated, sophisticated, and a bit of a raconteur, he took his economic degree, starting his banking career as a summer intern at State Street Bank and Trust in Boston. He was then promoted to a trader position for pension plans. It was State Bank that put Birkenfeld on his path as a whistleblower. He discovered irregularities in the banking procedures, and then fraud. But upon presenting the relevant documents to executives at the bank, they proceeded to fire him.

Birkenfeld took evidence of the currency transaction fraud at State Street Bank to the Federal Bureau of Investigation (FBI). Still, he found the FBI agents’ clueless’ about the complexities of the banking industry. The FBI asked Birkenfeld to work with them, but he declined. Birkenfeld stated that during that time, the “FBI was protecting Whitey Bulger.” The United States Attorney, who rejected the investigation, according to Birkenfeld, was Robert Mueller. Birkenfeld stated that he was “a young man who saw something wrong,” and his “instinct” was to call it out.

Birkenfeld’s next job was with Credit Suisse, a bank founded and based in Switzerland. He then transitioned to Barclays, where he established a client base, one client being billionaire real estate developer Igor Olenicoff. Birkenfeld left Barclays and went to UBS, a Swiss multinational investment bank and financial services company also founded and based in Switzerland. Birkenfeld’s job at UBS was business development for the United States. He was to bring “rich Americans” into UBS, and he already had a head start by bringing Olenicoff and Olenicoff’s $200 million account with him.

An American can have a bank account in Switzerland, but the U.S. Internal Revenue Service (IRS) requires that one must disclose the account and pay taxes. Bankers also must register with the U.S. Securities and Exchange Commission (SEC) in the U.S. Birkenfeld stated that he was the only American on the American desk at UBS. He found that thousands of American clients ignored the IRS rules, and many UBS bankers were recruiting UBS clients in the United States without registering with the SEC.

Swiss bankers felt that protecting their clients’ identities was a sacred trust. International banking law stipulates a separate group of clients, known as politically exposed people (PEP), who are treated with a higher degree of oversight to end international corruption. PEP is composed of government heads, judicial officials, military officials, political party officials and associates, and their family members. Although Birkenfeld did not sit in the PEP section at UBS, he could get the names of American PEP members.

Birkenfeld saw clients arriving at UBS with “millions of dollars in a suitcase.” Birkenfeld did not question where the money came from, explaining he was a banker, not a policeman.

UBS was aware that many banks were chasing the same clients—billionaires and millionaires—and strove to make their meetings memorable. Establishing an “emotional connection” with the uber-wealthy is not easy; administrators at UBS ranked bankers on their success in this area. UBS gave detailed and explicit instructions to UBS bankers on protecting the identity of wealthy American clients.

Birkenfeld’s time at UBS started ticking down after Birkenfeld’s colleague alerted him to a document posted on an internal server at UBS that gave instructions for private bankers. The document, never mentioned previously to Birkenfeld, was a set of instructions that appeared to be the opposite of what UBS executives were instructing. Birkenfeld took a copy of the policies and confronted his supervisor, who told him not to rock the boat. After that conversation, Birkenfeld copied and kept UBS documents. These documents detailed UBS’s illegal practices in their servicing of high-income Americans who were engaged in tax fraud.

Birkenfeld quit his “million dollar” job at UBS on October 5, 2005, and took a job as Partner at Union Charter Ltd, Geneva, Switzerland, in wealth management. In December of 2006, the United States Congress signed a new bill (Tax Relief and Health Care Act of 2006) into law which gave whistleblowers monetary awards for information regarding tax fraud:

(b) Awards to Whistleblowers-

(1) IN GENERAL- If the Secretary proceeds with any administrative or judicial action described in subsection (a) based on information brought to the Secretary’s attention by an individual, such individual shall, subject to paragraph (2), receive as an award at least 15 percent but not more than 30 percent of the collected proceeds (including penalties, interest, additions to tax, and additional amounts) resulting from the action (including any related actions) or any settlement in response to such action. The determination of the amount of such award by the Whistleblower Office shall depend upon the extent to which the individual substantially contributed to such action.

In 2007, Birkenfeld approached the U.S. Department of Justice (DOJ) with “memos, PowerPoint presentations, and accounting papers” regarding UBS. Birkenfeld stated that UBS “was dead in the water,” as he had the goods on them regarding tax fraud. Birkenfeld felt that right from the start, the DOJ was hostile toward him. One DOJ official thought he was merely a tipster, not a whistleblower. Birkenfeld wanted a subpoena to provide information to the DOJ, but they rebuffed him. Birkenfeld said, “It was a whistleblower who revealed the largest tax fraud in the world, where was the IRS, the Federal Reserve?” Birkenfeld answers his own question, saying, “They are in bed together.”

Birkenfeld stated that the Central Intelligence Agency (CIA) had secret offshore accounts at UBS. Birkenfeld regrets he did not keep the dossier on the CIA. Birkenfeld noted that he does not think the DOJ “likes whistleblowers.” He feels the DOJ wanted to indict him, so he “would not be paid as a whistleblower.” Birkenfeld provided information regarding tax fraud, extortion, bribery, corruption, and terrorist activities to the DOJ, and they treated him poorly. He feels that the U.S. government enables and protects wealthy and powerful American politicians, movie stars, and industry heads to break the law.

Birkenfeld went to the DOJ and asked for immunity or a subpoena because he would go to jail in Switzerland if he provided information without protection. The DOJ wanted Birkenfeld to give up names but would not give him a subpoena. Birkenfeld provided names to the U.S. Senate, but the DOJ continued in their persecution of Birkenfeld.

Birkenfeld worked at Union Charter LTD until June of 2008 and wanted the protection of a subpoena, but the DOJ would not provide one. The DOJ’s refusal resulted in their indictment of Birkenfeld for not providing enough information. He was arrested in June 2008 as he returned from Switzerland to attend his high school reunion in Boston. Birkenfeld had already talked to the IRS, DOJ and the SEC, also appearing before the Senate. Birkenfeld’s law team at Kohn, Kohn and Colapinto, who only represented him in his IRS whistleblower claim, not his criminal case, noted that it would be a severe disincentive if whistleblowers could be tripped up by inadvertently leaving out some information the government found out about later. Most importantly, Birkenfeld was still working in Switzerland as a banker, and it put him in serious jeopardy if the DOJ did not provide cover via a subpoena.

Birkenfeld pled guilty to one count of conspiracy and was sentenced in a federal court in Florida in 2009. The prosecutor for the DOJ said in federal court: “I will say that without Mr. Birkenfeld walking into the door of the Department of Justice in the summer of 2007, I doubt as of today that this massive fraud scheme would have been discovered by the United States government.”

Birkenfeld was sentenced to thirty months in prison and released in August of 2012. After spending 20 months in home confinement, one month in community confinement, and three months in post-prison home confinement, Birkenfeld asked a federal judge to end or modify his parole terms so he could leave the U.S. The DOJ opposed early termination.

Birkenfeld’s disclosures have been global in nature. Banks have paid billions in penalties. The IRS offered a series of programs allowing Americans to reveal their secret offshore accounts or pay hefty penalties. In 2010, Congress passed a law that forces banks to disclose accounts held offshore by Americans. Birkenfeld changed the financial world. In 2014, a report by the Senate’s Permanent Subcommittee on Investigations slammed the DOJ for their investigation of Birkenfeld and a lack of follow-through.

Birkenfeld stated that “100% he would do it again.” He advises whistleblowers that they should, “1. Talk to other whistleblowers, 2. Get good legal counsel, and 3. Find someone you trust in the media who can present your facts anonymously.”

When Birkenfeld got out of jail, his lawyer Stephen Kohn, flew to New Hampshire with the IRS check. Birkenfeld described Kohn as a “diminutive guy with wiry grey hair, glasses, and always an optimistic grin; he was smart as they come and feisty as a pit bull. The only lawyer still on my side was Kohn, and he wasn’t getting paid.” Kohn was convinced the government owed Birkenfeld a “fat reward” and was “going to die trying.”

When Kohn presented Birkenfeld with his $104 Million award, they both looked at each other and just smiled.

Currently, Birkenfeld is living in Malta, helping other whistleblowers and the underprivileged.

© 2020 Whistleblower Network News