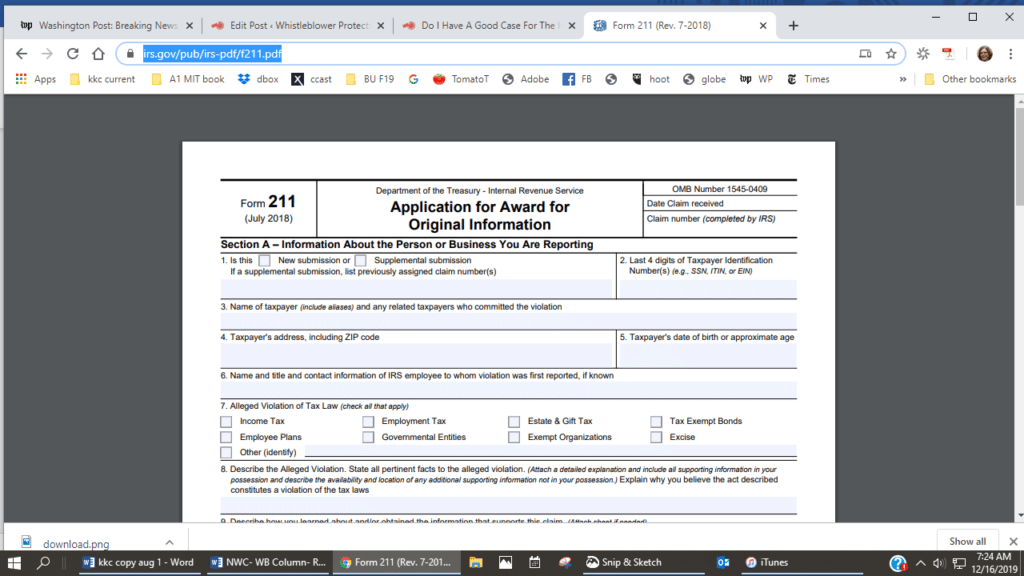

The IRS Whistleblower Office has launched a digital version of Form 211. Officials say this update will make it easier for people to report tax noncompliance and fraud.

With the new online Application for Award for Original Information, whistleblowers can now send detailed tips securely and quickly. This reduces the need for paper forms and helps lower errors and processing costs.

“Enhancing the taxpayer experience is one of the top priorities of the IRS Whistleblower Office,” said Acting Director Erick Martinez. He added that the new online form can be filled out on a phone or a laptop.

The IRS says whistleblowers are essential for keeping the tax system fair. Since the program began, tips from whistleblowers have helped collect over $7 billion in tax liabilities, and more than $1.4 billion in awards have been paid.

The IRS will still accept Form 211 by mail, but encourages people to use the digital version to make reporting easier. You can find more details and links to the online form on the Whistleblower Office page at IRS.gov.